Do You Need an Accountant for Your Small Business?

Wondering if you need an accountant? See when to hire one, what tools to use, and how Adam by Tyms makes small business accounting effortless.

Temitope Ayegbusi

Many business owners and entrepreneurs often ask: “Do I need an accountant for my small business?” It’s a common question, especially when launching or scaling a new venture. You might wonder whether managing your own finances is truly feasible or if it’s smarter to bring in professional help.

According to Forbes, 99.9% of all U.S. enterprises fall into the small business category, that’s 33.2 million organizations forming the backbone of the American economy. Together, they employ nearly half of the nation’s workforce.

Financial management doesn’t have to feel overwhelming. With the right tools, systems, and knowledge, many small business owners can handle a large portion of their accounting themselves.

This guide will help you understand the fundamentals, recognize when to get professional help, and choose tools that make financial management simple and accurate.

What Is Small Business Accounting?

Small business accounting is the process of recording, classifying, and summarizing every financial transaction in your business. It helps you track where your money comes from and where it goes, ensuring that every dollar is accounted for.

The main goal is to produce accurate financial reports that show how your business is performing, support better decision-making, and strengthen your position when applying for small business loans. In simple terms, accounting transforms raw numbers into insights that drive smarter choices.

Below are the core areas every small business should focus on:

1. Identifying Gaps in Your Current System

Start by reviewing how you currently manage your books. Are your income and expenses properly tracked, or do receipts pile up until tax season? Spotting these inefficiencies early helps you decide whether simple accounting software is enough or if you need expert guidance.

2. Evaluating Your Business Size and Complexity

Your accounting needs grow as your business grows. A freelancer’s setup might work for a one-person shop but not for a company managing employees, inventory, or multiple revenue streams. As operations expand, an accountant ensures your records stay accurate and compliant.

3. Setting Up the Right Tools and Software

Choose accounting software that matches your business model. The right tool automates data entry, tracks invoices, and generates real-time reports, saving time and reducing costly errors.

4. Staying Compliant With Taxes and Regulations

Accurate bookkeeping is more than just recordkeeping, it’s about compliance. Staying ahead of tax obligations, payroll filings, and state-specific requirements prevents penalties and keeps your business in good standing.

5. Using Financial Reports to Make Better Decisions

Accounting isn’t just for filing taxes. Regularly reviewing your balance sheet, income statement, and cash flow statement helps you understand performance, spot inefficiencies, and plan for growth confidently.

Choosing the Right Accounting Software

The right tools can turn financial management from a chore into a strategic advantage. Modern accounting software automates tedious tasks, saving hours and improving accuracy.

Your first decision usually comes down to choosing between free or paid platforms, and this depends on your business size, transaction volume, and reporting needs.

How Adam by Tyms Helps Non-Accountant Small Business Owners Get Accounting Right

If you’re not an accountant but still want accurate books, Adam by Tyms simplifies everything.

Step 1: Create an Account

Sign up in seconds using just your email and password. No complex setup, you’re in right away.

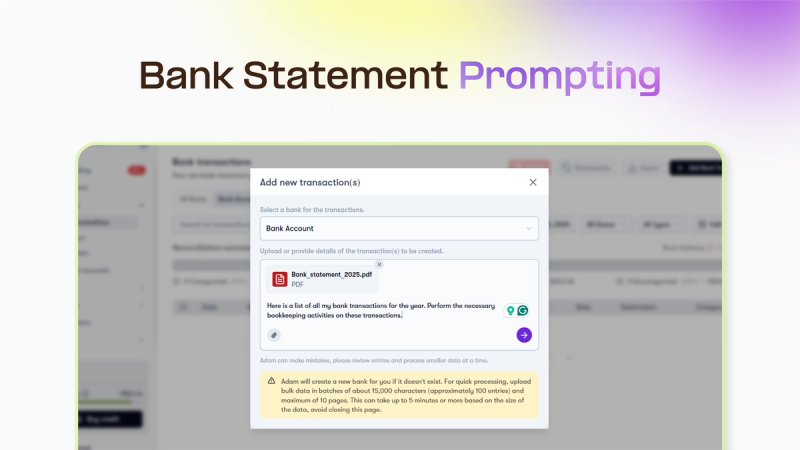

Step 2: Direct Bank Sync or Upload Statements

If you have existing bank statements, Adam can import and categorize them automatically. Every payment, deposit, and expense is classified by AI, while duplicates or missing entries are flagged for review.

Example:

- A $600 payment to Lowe’s? Tagged as materials.

- A $1,200 Stripe deposit? Categorized as client income.

- A recurring SaaS fee? Marked as monthly expense.

You can also connect your U.S. bank account directly for automatic syncing.

Step 3: Connect QuickBooks to Adam by Tyms

If you are already using QuickBooks, Adam integrates seamlessly with your Quickbooks accounts. It auto-categorizes “uncategorized” expenses, eliminates manual cleanup, and produces accurate reports instantly.

Step 4: Automate Receipts from WhatsApp & Email

Receipts often arrive through WhatsApp, email, or screenshots. Adam automatically pulls and attaches them to matching transactions, ensuring everything is organized for tax time.

Whether you use bank sync, statement upload, or QuickBooks connection, the goal is the same, effortless bookkeeping.

Get started with Adam today and see how much smoother accounting can be.

Understanding Key Financial Reports

Knowing how to interpret your financial reports empowers you to make informed, data-driven decisions instead of guessing. These core statements reveal your company’s full financial picture and improve your loan eligibility.

1. Balance Sheet Report

Your balance sheet provides a snapshot of what your business owns (assets) and owes (liabilities). Comparing sheets over time reveals trends and progress toward your financial goals.

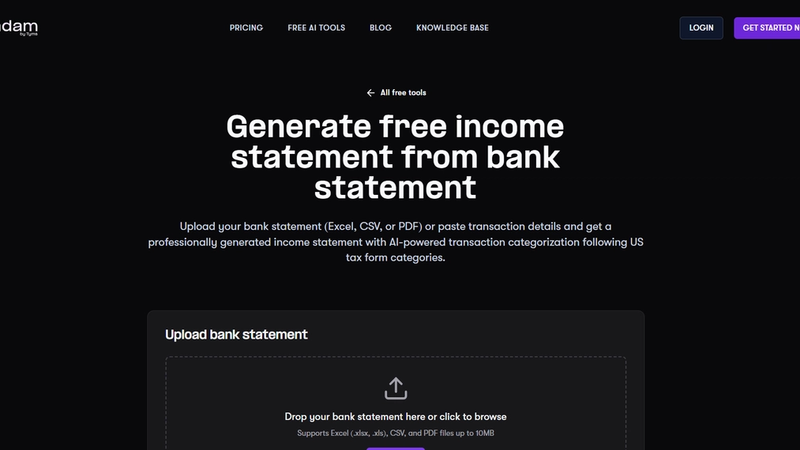

2. Income Statement Report

The income statement shows your revenue, expenses, and profit over a period. It helps you see which products or services generate the most income, guiding you toward better investment decisions.

Use our free income statement from bank statement generator tool

3. Cash Flow Report

Your cash flow statement shows how money moves in and out of your business. It helps you stay prepared for bills, investments, and seasonal fluctuations, forming the foundation for smart budgeting.

Deciding When You Need an Accountant

Knowing when to shift from DIY accounting to professional help is a key growth decision. Even with great tools and habits, expert guidance eventually becomes essential at some point. If you’re at any of these stages, it is time to get an accountant to take a look at your books.

1. Rapid Business Growth

When your business expands with multiple income streams or employees, an accountant ensures accurate tracking and compliance.

2. Major Investments or Expansion Plans

Before hiring staff, purchasing equipment, or opening new locations, an accountant evaluates your financial readiness and tax implications.

3. Applying for Business Loans

Accountants prepare professional financial statements and projections that increase your chances of loan approval and favorable terms.

4. Increasing Tax Complexity

If managing payroll, sales tax, or multi-state operations becomes confusing, a CPA keeps you compliant and maximizes deductions.

5. Adopting a Hybrid Accounting Approach

You can manage daily bookkeeping while relying on a CPA for strategic insights, balancing cost with expert oversight.

6. Feeling Overwhelmed by Financial Management

When accounting consumes too much time or causes stress, outsourcing frees you to focus on growth and revenue generation.

Conclusion

Taking control of your financial operations builds a foundation for long-term success. With the right structure , from choosing accounting software to maintaining organized reports, what once felt complex can become manageable.

Whether you handle your books yourself or work with a professional, accurate data fuels smarter decisions and sustainable growth. Stay consistent, review your reports regularly, and use automation tools like Adam by Tyms to simplify your accounting journey.

You can also read:

Master your finance with a free Excel Income Statement Template

Using an Excel income statement template isn't just about filling in numbers; it's about getting a clearer picture of how your business is actually doing.

Temitope Ayegbusi

Jan 30, 2026

Accounting Automation Software Features That Actually Matter (For Small Businesses)

This guide breaks down accounting automation software features that truly matter, explains how popular tools approach automation, and helps small business owners understand what to look for before choosing the wrong solution.

Temitope Ayegbusi

Jan 22, 2026