Accounting for Consultants: How to Build a Smarter Financial System That Works

Learn how to simplify accounting for consultants with AI-powered bookkeeping, smart reports, and project-based tracking from Adam by Tyms.

Temitope Ayegbusi

Consulting is one of those professions that looks flexible from the outside but often feels like juggling five things at once. You’re building client strategies, running presentations, preparing reports, managing payments, and in between, trying to make sense of your own finances. Accounting for consultants doesn’t have to be rocket science, it can be as simple as an AI-powered bookkeeping process that only takes a few minutes a week.

If you’ve ever paused mid-month wondering, “Wait, how much did I actually make this month?” you’re not alone. Many consultants have brilliant client systems but chaotic personal ones. And when it comes to accounting, it’s easy to leave things till “later,” until that later becomes tax season.

But the truth is, accounting for consultants doesn’t have to be difficult. You just need a clear system, one that helps you track contracts, manage client retainers, handle financial reporting for consultants, and see your financial health in real time.

In this guide, we’ll break down how to build that system, one step at a time. You’ll also see how AI-powered tools like Adam by Tyms quietly automate the background tasks that take up your time, without you needing to be an accountant.

Why Accounting for Consultants Needs Structure

Every consulting business is different, but one thing remains the same: unpredictability. You might have a few client retainers that pay monthly, some one-off contracts, and maybe a few unpaid invoices sitting somewhere in your inbox.

That irregular flow makes accounting for consultants slightly trickier than for regular small businesses. There are no fixed “sales cycles.” You close one project today, get paid in 14 days, and might not see another payment until next month.

Without structure, this creates confusion. You end up:

- Forgetting unpaid invoices or client retainers

- Mixing business and personal expenses

- Guessing your profitability

- Overpaying taxes because you lack clear deductions

What’s needed isn’t complex software or a degree in accounting, it’s a process. A repeatable, simple financial rhythm.

Before we dive into the steps, let’s pause a bit and talk about what really matters to consultants. What features make accounting software easier for your consulting business?

What Features Should a Consultant Look for in an Accounting Tool?

If you’ve been a consultant for a while, you already know that accounting for consultants isn’t just about keeping receipts. It’s about tracking the flow of money between projects, clients, and retainers, without getting lost in spreadsheets or tangled up with complex tools like QuickBooks.

Here’s what to look out for when choosing the right tool (and what Adam by Tyms already helps you handle):

Client Retainers and Project-Based Accounting

Consulting often means juggling multiple clients and projects at once. You need a tool that helps you organize your earnings and expenses by client or project. With project-based accounting, you can see exactly which client brings in what and which project eats into your profit margins.

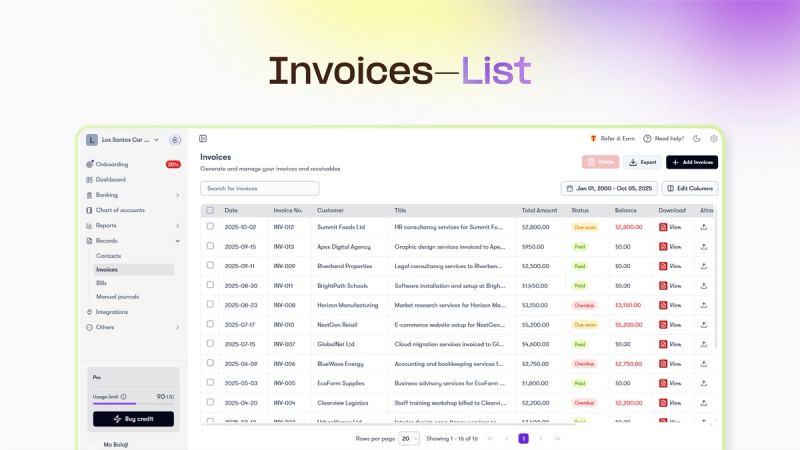

Smart Invoice Management

Sending invoices shouldn’t take your entire afternoon. A good accounting tool should make it simple to create, send, and track invoices, without needing a finance degree. With invoice management built into Adam, you can generate invoices in minutes and keep tabs on which ones are paid, pending, or overdue.

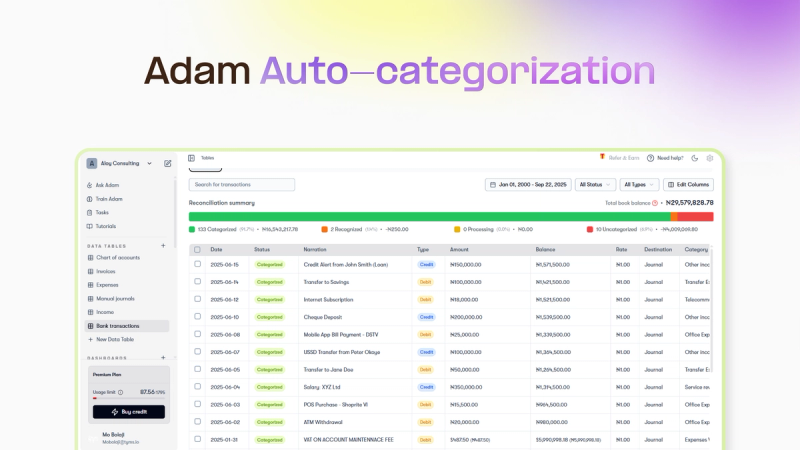

AI-Powered Bookkeeping

This is where modern accounting really shines. Instead of manually categorizing expenses or fixing duplicate entries, AI-powered bookkeeping handles it automatically. It learns your transaction patterns, categorizes income and expenses, and keeps you accurate, even when your schedule is packed.

Expense Management That Works

Consultants spend a lot on tools, travel, and subscriptions. Without a system, these expenses pile up fast. Adam makes expense management easier by syncing your bank account, sorting every transaction into the right category, and helping you understand where your money goes.

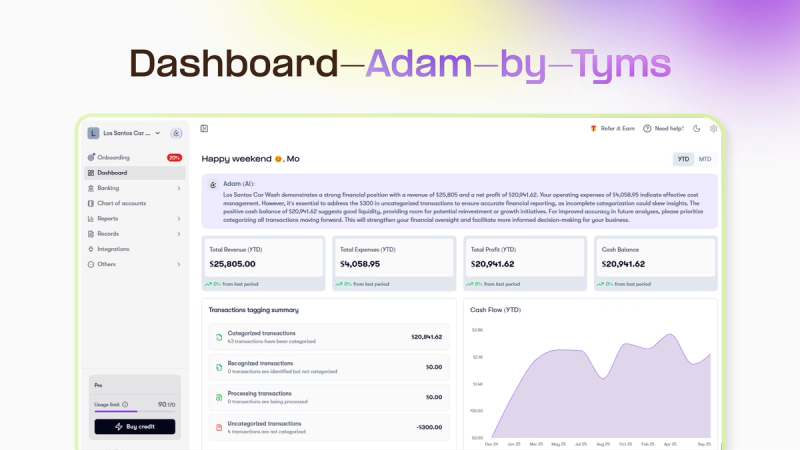

Financial Reporting for Consultants

At the end of the day, you want clarity. You want to know how your business is doing, and whether your consulting hours are translating into real profit. With financial reporting for consultants, Adam helps you see your cash flow, profit & loss, and overall financial health in one simple dashboard.

Tax Preparation for Independent Professionals

Tax time doesn’t have to be a nightmare. By keeping your income and expenses properly categorized throughout the year, Adam simplifies tax preparation for independent professionals. You get clean, ready-to-share reports that make filing smoother and more accurate.

Step 1: Separate Your Finances — Create a Dedicated Business Account

The first step is surprisingly simple: separate your consulting income from personal money.

This single act gives you clarity. You’ll always know how much came in, what went out, and how much is left to reinvest. A dedicated account also helps when applying for credit, filing taxes, or proving income to clients and agencies.

If you run a registered accounting and consulting company, this is non-negotiable. Even if you’re a solo consultant, think of your consulting business as its own entity.

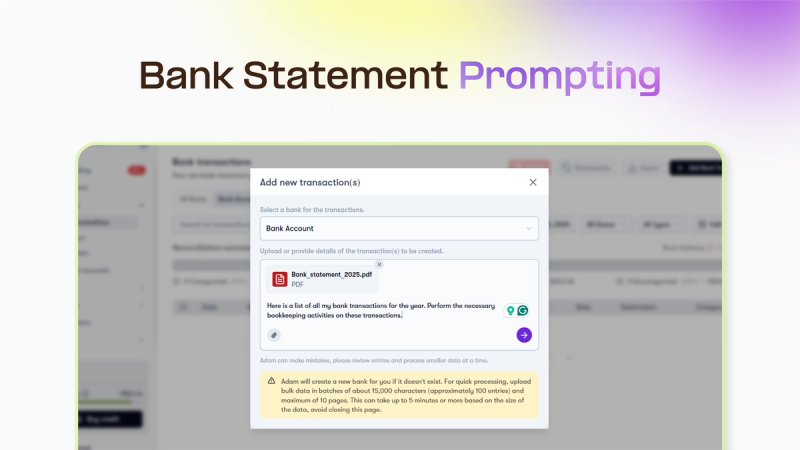

Step 2: Connect Your Bank Account or Upload Bank Statements

The second step is also simple, Sign up on Adam by tyms.

Every transaction that goes in and out needs to be documented, not just for tax deduction purposes, but to keep you informed about your financial health.

After signing up on Adam by Tyms, you can either upload bank statements or connect your business account directly.

Once connected, Adam automatically tracks every transaction, helping you categorize expenses intelligently and saving you hours of manual work.

Step 3: Categorize Every Expense — Intelligently

Consultants spend across different areas: travel, subscriptions, marketing, professional courses, and sometimes outsourcing. The problem isn’t spending, it’s when expenses lack context.

Here’s what your categories might look like:

- Travel & Client Meetings

- Tools & Software

- Professional Fees

- Marketing

- Education

- Taxes & Compliance

Most tools make you tag each one manually. But with AI-powered bookkeeping in Adam, your transactions are auto-categorized the moment they sync.

Step 4: Reconcile Weekly, Not Yearly

Most consultants make one accounting mistake that costs them peace, waiting until December to “check the books.”

Instead, set a weekly financial review. Spend 20–30 minutes every Friday to:

- Match payments

- Log expenses

- Update invoices

- Record taxes

If you’re using Adam by Tyms, most of this is already automated. You just log in, see what changed, and move on. That’s what makes it one of the best bookkeeping software for freelancers and consultants alike.

Step 5: Review Your Business Like a Client Project

Treat your business like a client. You wouldn’t deliver incomplete reports to a client, so don’t ignore your own.

At month-end, review:

- Total income vs. total expenses

- Client profitability

- Growth or decline

- Cash in hand vs. expected payments

This is how consultants evolve from freelancers to real businesses. If you notice that one project-based accounting area underperforms, Adam’s dashboard will show it instantly, so you can fix it before it hurts your bottom line.

Step 6: Build a Tax and Savings Structure

Consultants don’t get automatic tax deductions, so you must plan ahead.

Here’s a simple breakdown:

- Save 25–30% for taxes

- 10% for emergencies

- 5% for upskilling

With Adam by tyms, you can track these allocations easily and export summaries during tax preparation for independent professionals, making compliance stress-free.

Step 7: Download Tax-Ready Reports and Get Financial Insight

Here’s where all your effort pays off.

Once your transactions are categorized and synced, Adam by Tyms lets you generate powerful reports and insights without the accounting headache.

In just a few clicks, you can:

- Download Tax-Ready Reports — including Profit & Loss, Balance Sheet, and Cash Flow Statements.

- View Real-Time Insights — see income by client or project, track growth trends, and watch profit margins.

- Spot Trends Early — visual dashboards help you see which client retainers perform best or which costs are quietly rising.

You don’t need to be an accountant to understand it. Adam turns financial reporting for consultants into clarity and action.

Try Adam by Tyms today , the most flexible accounting software built for consultants, freelancers, and other self-employed professionals who want to focus on work, not paperwork.

You can also read:

How to Catch Up on Bookkeeping (Without Hiring an Expensive Service)

Many small businesses search for catch up bookkeeping software when they want to fix overdue records without hiring a service.

Temitope Ayegbusi

Jan 14, 2026

QuickBooks Pricing 2025: Full Breakdown and a Better Alternative That Saves You Hours

If you’re still comparing options or want to understand QuickBooks pricing in 2025, see our full breakdown of QuickBooks pricing and alternatives

Temitope Ayegbusi

Dec 15, 2025