Accounting for Freelancers: How to Master Finances with Smart Tools and Flexible Software

Discover the best freelance accounting software for self-employed professionals. Learn how flexible tools like Adam by Tyms simplify bookkeeping, invoicing, and taxes for freelancers.

Temitope Ayegbusi

A Freelance Guide to Managing Money, Taxes, and Bookkeeping Without the Stress

Freelancers are the new small businesses. Whether you’re a designer, writer, consultant, or developer, one truth stays constant, managing your finances can feel like a second job. You’re your own boss, marketer, and accountant all in one. And between chasing clients, creating deliverables, and keeping up with invoices, bookkeeping often falls to the bottom of the to-do list.

But ignoring your books can cost you more than just time. It can mean missed tax deductions, late payments, and the anxiety that comes with not knowing where your money is going.

That’s why many independent professionals are turning to freelancer accounting software, tools built to simplify how self-employed people track income, categorize expenses, and manage taxes. And among the growing list of tools, Adam by Tyms stands out as one of the most flexible, intuitive, and affordable options designed for freelancers.

In this guide, we’ll break down everything you need to know about freelance accounting, from setting up your system to choosing the best software for your workflow.

Why Freelance Accounting Is Harder Than It Looks

When you’re self-employed, your finances don’t behave like a normal business. Your income is irregular, your clients pay on different schedules, and your expenses are a mix of personal and business.

Here’s what typically happens:

- You get paid by a few clients one month and almost nothing the next.

- You forget to log a business lunch or software subscription.

- You realize, three days before tax filing, that you’ve misplaced receipts worth hundreds in deductions.

Sound familiar?

This is why freelancers need flexible accounting software, a tool that adapts to unpredictable income, integrates easily with your bank, and automates categorization so you can focus on your craft, not your spreadsheets.

What Accounting Really Means for Freelancers

Accounting isn’t just “keeping track of money.” For freelancers, it means having financial clarity, i.e., knowing where your money comes from, where it goes, and what’s left after taxes.

Here’s the basic breakdown:

- Bookkeeping: Recording income and expenses accurately.

- Accounting: Turning those records into insights and reports (like profit and loss statements).

- Tax Management: Planning and paying self-employment taxes on time.

Without these systems, freelancers struggle to price their work correctly, predict dry months, or understand whether they’re actually profitable.

Common Accounting Mistakes Freelancers Make (and How to Fix Them)

Even experienced freelancers fall into these traps:

- Mixing business and personal expenses : This makes tax filling messy and reduces deductible accuracy. To solve this, open a separate business account and set up accounting instantly.

- Ignoring receipts : You will lose deductible proof and IRS compliance . With AI tools you can connect your US bank, and mail to capture email instantly.

- Skipping monthly reviews : Without this, you won’t see where money leaks. Scheduling a 15 min money check weekly to look at your transactions will make a lot of difference.

How to Manage Irregular Income Like a Pro

Freelancers live with inconsistent paydays. But smart accounting helps you stabilize cash flow.

Here’s how:

- Create a baseline budget: Find your average monthly expenses and save 25–30% of every payment for taxes.

- Pay yourself a salary: Transfer a fixed amount monthly from your business account to your personal one.

- Use reports to predict slow months: A tool like Adam shows trends so you can prepare ahead.

With a good self-employed accounting software, your finances start to look predictable, even when your income isn’t.

Choosing the Best Freelance Accounting Software

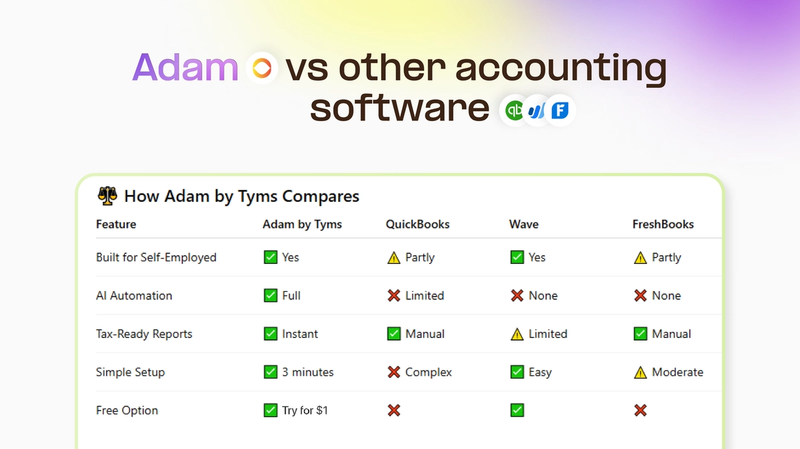

There are dozens of accounting software options out there , QuickBooks, FreshBooks, Wave, Xero, and Adam by Tyms , but not all are designed for freelancers.

Let’s compare what matters: we asked Chatgpt to compare Adam by tyms to other software.

For most freelancers, Adam by Tyms is the most flexible accounting software, combining AI automation, human support, and affordability in one tool.

Try Adam by Tyms for $1 today and experience automated bookkeeping designed for self-employed professionals.

Why AI and Automation Are Game-Changers for Freelancers

Freelancers don’t have time to become accountants, and with AI, you don’t have to.

Modern freelance accounting software like Adam by Tyms uses AI to automate tedious bookkeeping. You can:

- Connect your bank, and Adam auto-categorizes every transaction.

- Generate instant financial reports, no formulas, no Excel.

- Ask simple questions like “How much did I make last month?” using its “Ask Adam” feature.

- Automatically prepare tax-ready records, saving hours of manual work.

In short, it feels like having a personal accountant, without the cost.

A good Example: Emma, a freelance web designer, used to spend weekends reconciling PayPal and Stripe payments. After switching to Adam, all her transactions categorized themselves automatically. Now, she spends 10 minutes reviewing her P&L each week and no longer fears tax time.

Tax Planning Made Simple for Freelancers

If there’s one thing freelancers fear more than client delays, it’s taxes.

Here’s what every self-employed person should know:

- You’re both employer and employee. That means paying self-employment tax (15.3%) on top of income tax.

- Quarterly payments matter. Set reminders for April, June, September, and January.

- Deductions are your best friend. Claim home office, equipment, software, travel, and even health insurance. Read more on tax deductions.

Use Adam by Tyms to generate tax-ready reports automatically. It helps you stay compliant without needing to be a tax expert. Try Adam by Tyms for $1 today.

Building a Simple Accounting Routine That Works

Here’s a weekly and monthly checklist that keeps your finances organized:

Weekly:

- Record all payments received

- Categorize expenses (automated with Adam)

- Check outstanding invoices

Monthly:

- Generate your Profit & Loss report

- Compare income vs. expenses

- Review your tax savings

Consistency beats complexity. Using automation ensures you stay consistent, even when business gets busy.

When to Hire a Freelance Accountant

Even with great tools, some freelancers benefit from extra help, especially during rapid growth or complex tax situations.

Hire an accountant when:

- You make over $80,000/year from freelancing

- You’re forming an LLC or S Corp

- You need financial forecasting or audit prep

You can still use Adam by Tyms to maintain daily books, while your accountant handles strategy.

Try Adam by Tyms for $1 today.

Conclusion: Own Your Freelance Finances

Freelancing gives you freedom, but real freedom comes when your finances are under control.

With the right tools, a simple routine, and an AI-powered accounting partner like Adam by Tyms, you can stop stressing about taxes, invoices, and spreadsheets. Instead, you’ll have clarity, confidence, and control.

Because at the end of the day, your freelance work deserves to feel like a business, not a balancing act.

You can also read:

How to Catch Up on Bookkeeping (Without Hiring an Expensive Service)

Many small businesses search for catch up bookkeeping software when they want to fix overdue records without hiring a service.

Temitope Ayegbusi

Jan 14, 2026

QuickBooks Pricing 2025: Full Breakdown and a Better Alternative That Saves You Hours

If you’re still comparing options or want to understand QuickBooks pricing in 2025, see our full breakdown of QuickBooks pricing and alternatives

Temitope Ayegbusi

Dec 15, 2025