Applying AI to Your Small Business (Accounting, Operations, and Customer Service)

Discover how to apply AI to your small business. Learn how AI simplifies accounting, automates operations, and improves customer service.

Temitope Ayegbusi

Why Every Small Business Needs an AI App Today

AI isn’t just for big corporations anymore. From your local bakery to a digital marketing agency, small businesses everywhere are using AI apps to simplify work, reduce mistakes, and scale faster.

Think about how much time you spend doing things like entering data, replying to emails, or figuring out where your money went. Artificial intelligence now handles many of those tasks automatically, therefore, giving you back hours every week.

It is even more interesting because, you don’t need to be a tech expert to use AI Software or an accountant to use an AI accounting software. Modern AI business tools are designed to be simple, intuitive, and affordable.

Let’s break down how to apply AI to your small business in three key areas: accounting, operations, and customer service.

Applying AI to Accounting - Simplifying Bookkeeping and Financial Management

Accounting is one of the hardest parts of running a small business. If you’ve ever tried to use traditional tools like QuickBooks, you probably know the pain of having complicated dashboards, endless setup, and hidden fees.

That’s why more small business owners are switching to AI accounting software. AI makes bookkeeping feel effortless. You can connect your bank, upload statements, and let the system do the rest , automatically sorting your transactions, generating reports, and explaining your numbers in plain language.

Here’s how AI can help in your accounting process:

- Automated Transaction Categorization Instead of spending hours classifying income and expenses, AI bookkeeping tools recognize spending patterns and categorize automatically. For example, Uber Eats is tagged as “Delivery Expense,” and Shopify deposits as “Sales Income.”

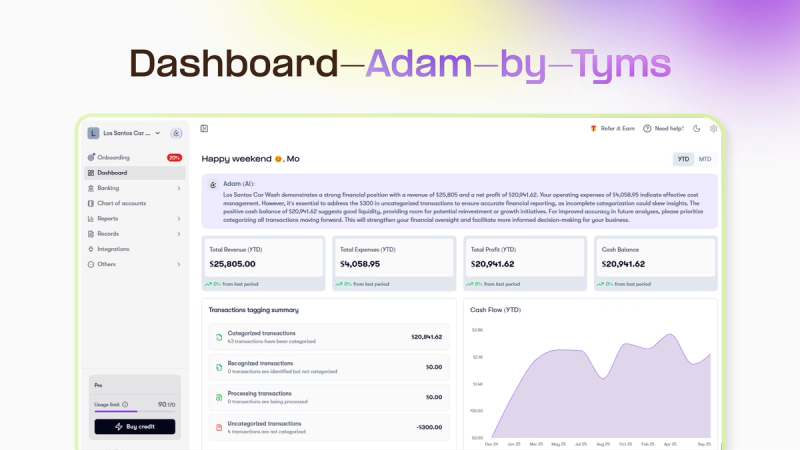

- Instant Financial Reports and Insights AI tools like Adam by Tyms can generate your income statement, balance sheet, and cash flow statement instantly. No formulas or spreadsheets needed. You can as well use the “Ask Adam feature” to ask, “What was my biggest expense this month?” and get an answer right away.

- Tax-Ready Reports When tax season comes, AI ensures your books are clean and ready. No last-minute panic or missing receipts.

Try Adam by Tyms, an AI accounting software built for small businesses. It automates categorization, creates financial reports and insights, and gives you human chat support in minutes.

Try Adam by Tyms for $1 today. These resources will help you understand your numbers better and make smarter financial decisions.

If you'd love to generate a free income statement from your bank statements, use our free income statement generator tool.

Applying AI to Operations — Automating Daily Business Tasks

Every small business owner knows how overwhelming operations can get, from managing inventory, sending invoices, following up on customers, tracking payments, to updating spreadsheets.

AI operations tools can automate many of these daily tasks, allowing you to focus on growth instead of administration.

Here’s how AI can streamline operations:

- Workflow Automation: Tools like Zapier and ClickUp AI can automatically move data between apps. For instance, when a customer fills out a form, an invoice can be created instantly.

- Document Creation: Apps like Notion AI or ChatGPT for business can generate proposals, meeting summaries, or SOPs in seconds.

- Inventory Tracking: Retail or e-commerce businesses can use AI to predict stock needs and avoid shortages.

Let’s say you run a small bakery. You can use Adam by Tyms for automated bookkeeping, while ClickUp AI reminds you to reorder flour when inventory runs low. That’s how AI frees you up to focus on baking, not bookkeeping.

If you’re not sure where to begin, start with one task that feels repetitive, then find an AI app that can handle it for you.

Applying AI to Customer Service — Making Every Interaction Faster and Smarter

Customers expect fast responses, but small teams can’t always be online. That’s where AI customer service apps come in.

AI tools can handle common questions, book appointments, and provide updates instantly. However, automation should never feel robotic, that’s why combining AI with human support works best.

Many businesses use chatbots like Intercom AI or Zendesk AI to handle FAQs. But for accounting and financial questions, there should be a balance between AI automation and genuine human help to ensure customers feel understood, not ignored.

Choosing the Best AI Apps for Small Businesses

With so many options, how do you pick the right AI apps for your business? Here’s a simple checklist:

- Ease of Use: Can you set it up without technical help?

- Automation Power: Does it truly save time, or just rebrand old features?

- Affordability: Is it priced for small business owners, not enterprises?

- Support: Can you reach a real person when needed?

For accounting, the easiest option is Adam by Tyms, an all-in-one AI bookkeeping and accounting software built for small businesses.

You can connect your bank, categorize expenses automatically, and generate financial reports with just one click.

Try Adam by Tyms for $1 today.

Conclusion

AI isn’t replacing small business owners, it’s empowering them. From accounting to operations to customer service, artificial intelligence can take care of repetitive work while you focus on what truly matters: strategy, creativity, and customer relationships.

If you want to get started with AI for your small business, begin with your finances.

You can also read:

Master your finance with a free Excel Income Statement Template

Using an Excel income statement template isn't just about filling in numbers; it's about getting a clearer picture of how your business is actually doing.

Temitope Ayegbusi

Jan 30, 2026

Accounting Automation Software Features That Actually Matter (For Small Businesses)

This guide breaks down accounting automation software features that truly matter, explains how popular tools approach automation, and helps small business owners understand what to look for before choosing the wrong solution.

Temitope Ayegbusi

Jan 22, 2026