Business Loan Financial Reports: What You Need & How to Create Them Automatically

Learn the exact financial reports lenders need for business loans , Income statement, balance sheet, cash flow, and how to create them instantly with Adam by Tyms.

Temitope Ayegbusi

Getting approved for a business loan takes more than a good idea or enthusiasm. It takes clarity, especially in your financial reports. Whether you're applying for a small business loan, SBA funding, or a private lender credit line, how you present your numbers can determine if you get approved.

Many small business owners get stuck at this stage because they don't have clean, accurate, and easy-to-understand reports. The good news is that you don't have to be an accountant to prepare them. You just need to know what lenders look for and how to generate those reports automatically.

This guide will walk you through every key report you need for a business loan, why it matters, and how you can create it in minutes using Adam by Tyms, your AI-powered accounting assistant.

Understanding Why Lenders Ask for Financial Reports

Before a lender decides to fund your business, they need evidence that you can pay them back. Financial reports provide that evidence. For a Small business loan, financial reports show your income trends, spending habits, assets, debts, and cash flow.

But lenders want stability and transparency beyond the numbers. Accurate and neatly presented reports signal that you understand your business finances, dramatically increasing your loan approval chances.

The Three Reports You Need for a Business Loan

Here are the three essential reports every lender expects to see, and how you can prepare each one quickly.

1. Income Statement (Profit and Loss Statement)

Your income statement shows how much money your business made and spent during a specific period. It highlights your revenue, expenses, and profit. Lenders look at this to determine how profitable your business is and whether you can afford loan repayments.

What lenders check:

- Are your revenues growing steadily?

- Are your expenses controlled?

- Is your profit margin consistent?

If your income statement looks confusing or incomplete, it can raise red flags.

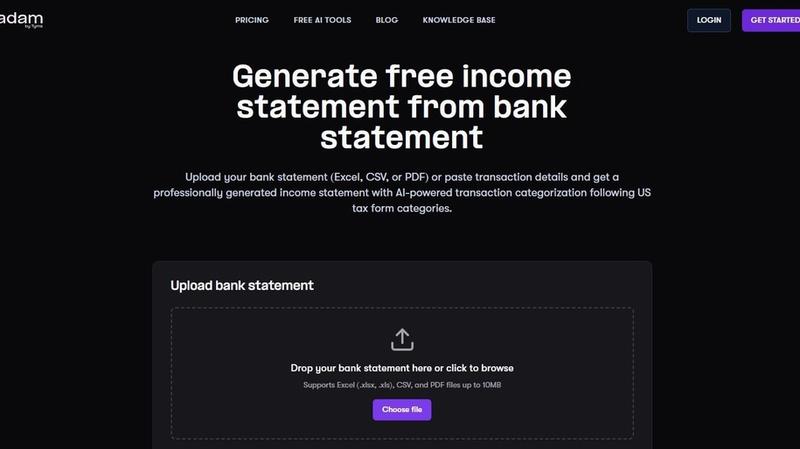

You can also use our Free Income Statement Generator to create a simple report within minutes, using your bank statement.

2. Balance Sheet

Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what’s left (owner’s equity). It’s basically a snapshot of your business’s financial health on a given day.

When applying for a business loan, lenders review your balance sheet to see if your business is financially balanced and stable.

What lenders check:

- Do your assets outweigh your liabilities?

- Do you have enough short-term cash or assets to cover expenses?

- Are you over-leveraged (too much debt)?

Manually preparing this can be tough, especially if your records are scattered.

But Adam by Tyms simplifies it by automatically generating a clean, balanced sheet, with totals that always match your accounting data.

Try Adam by Tyms for $1 today.

3. Cash Flow Statement

Even profitable businesses can struggle with cash flow. That’s why lenders pay special attention to your cash flow statement.

It shows how money moves in and out of your business. This report helps lenders see if you have enough cash to make repayments while running your operations smoothly.

What lenders check:

- Are you consistently bringing in more cash than you spend?

- Do you depend heavily on credit to stay afloat?

- Are there long gaps between receivables and payments?

If you’re using Adam by Tyms, cash flow reports are generated automatically as transactions are categorized.

You’ll instantly see where money comes from, where it goes, and when.

Automating Your Financial Reports for Loan Readiness

If you’re like most small business owners, your time is better spent running your business than preparing spreadsheets.

Automation can take off manual booking processes. Here’s what automation can do for you:

- Automatically categorize transactions as they happen.

- Generate clean financial statements for any period.

- Detect missing data or errors before submission.

- Export lender-ready reports instantly as PDFs.

With Adam by Tyms, once you connect your bank and upload past transactions, the system takes over. Within minutes, you get a full income statement, balance sheet, and cash flow statement ready for review.

And if you ever get stuck, you can reach out via live chat, and talk to a real person, not a bot. Most questions get answered in under three minutes.

Preparing Your Business Loan Application

Once your reports are ready, use them to fill out your business loan application confidently. Lenders typically ask for:

- Income Statement (covering the last 6–12 months)

- Balance Sheet (up-to-date snapshot)

- Cash Flow Statement (showing liquidity and repayment ability)

- Tax returns (optional but helps verify accuracy)

Review your numbers before submission. Ensure that all reports align and no figures contradict each other.

Practical Example: Applying for a Small Business Loan

Let’s say you run a small bakery and want a $20,000 business loan to expand operations.

Your lender will likely ask for:

- Income statement showing at least $10,000 monthly sales.

- Balance sheet showing $15,000 in assets and less than $5,000 in liabilities.

- Cash flow statement proving you have enough monthly inflow to repay $800–$1,000 installments.

Common Mistakes to Avoid Before Applying for a Loan

- Mixing personal and business finances. Always separate your accounts.

- Submitting outdated reports. Lenders prefer reports no older than three months.

- Ignoring small expenses. Those small fees can add up and distort profit margins.

- Not reconciling your bank accounts. Ensure every transaction matches.

- Using inconsistent report formats. Automated reports from Adam follow professional templates recognized by lenders.

Final Review Checklist

Before you send your application, confirm:

- All three reports are up to date.

- Your assets, liabilities, and equity balance correctly.

- You have clean income and cash flow data.

- Reports are exported as PDFs and titled clearly.

If you check all boxes, you’re ready to apply with confidence. Want to start generating your report ?

Try Adam by Tyms for $1 today.

FAQ

- What financial reports are needed for a business loan? You’ll typically need an income statement, a balance sheet, and a cash flow statement. Some lenders may also request tax returns or projections.

- Can I create these reports without an accountant? Yes. Tools like Adam by Tyms automate accounting tasks, generate clean reports, and explain financial data in simple terms.

- How do I make sure my reports are accurate? Connect your business bank account to your accounting software, review categories, and ensure transactions are updated regularly.

- Can automation really help me get approved faster? Absolutely. When your reports are clear, organized, and error-free, lenders trust your application more. Automation ensures consistency and accuracy.

- Where can I generate my reports for free? You can try the Free Income Statement Generator, on the Adam by Tyms website.

You can also read:

Income Statement vs Balance Sheet: Understand the Difference and Generate Both in Minutes from Your Bank Statement

Understand the key difference between an income statement and balance sheet, and learn how to generate both in minutes from your bank statement with Adam

Temitope Ayegbusi

Oct 24, 2025

The Fastest Way to Generate a Profit & Loss Statement

Are you looking for a quick and efficient way to create a simple profit and loss statement? Use our free income statement generator tool to get your report in minutes.

Temitope Ayegbusi

Sep 29, 2025