Income Statement vs Balance Sheet: Understand the Difference and Generate Both in Minutes from Your Bank Statement

Understand the key difference between an income statement and balance sheet, and learn how to generate both in minutes from your bank statement with Adam

Temitope Ayegbusi

If you’ve ever tried to make sense of your business finances and found yourself asking, “Wait, what’s the difference between an income statement and a balance sheet?”, you’re not alone.

It’s one of the most common questions small business owners and freelancers ask. These two reports are the backbone of your financial clarity, yet, they often feel confusingly similar.

Here’s the truth: once you understand what they do and how they connect, you’ll see how both reports tell the full story of your business. And better still, with tools like Adam by Tyms, you can generate both automatically, straight from your bank statement, in just minutes.

Let’s break it down in the simplest way possible.

What Is an Income Statement?

Think of your income statement as a movie, it shows everything that happened over a period of time.

It tells you:

- How much money came in (your revenue),

- How much went out (your expenses),

- And what’s left at the end (your net profit or loss).

That’s why it’s often called the Profit and Loss Statement (P&L), because it summarizes how profitable your business has been during a given period.

Let’s make it real: Imagine you’re a freelance designer. Over the last month, you earned $6,000 in client payments and spent $2,000 on software, internet, and marketing. Your income statement would show $4,000 profit.

This simple report answers the question: “Did my business make money this month?”

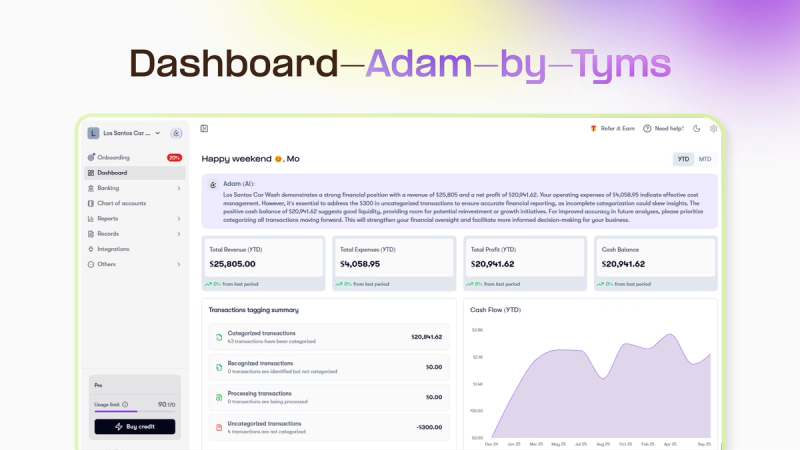

If you use Adam by Tyms, you don’t even have to calculate it yourself. Once you connect your bank statement, Adam automatically categorizes your transactions and builds your income statement for you , complete with charts that show how your earnings and expenses are trending.

What Is a Balance Sheet?

If your income statement is a movie, your balance sheet is a snapshot , a photo of your business’s financial position at a specific moment.

It answers a different question: “What is my business worth right now?”

Your balance sheet shows three things:

- What you own (your assets — like cash, inventory, or equipment),

- What you owe (your liabilities — like loans, credit cards, or unpaid bills),

- What’s left (your equity — the value that truly belongs to you).

Here’s a simple way to picture it: Let’s say your business bank account has $10,000, your laptop is worth $2,000, and you owe $3,000 on a credit card. Your balance sheet shows $12,000 in assets, $3,000 in liabilities, leaving $9,000 in owner’s equity.

So, while your income statement shows whether you’re profitable, your balance sheet shows whether you’re financially healthy.

When you connect your bank and upload transactions to Adam by Tyms, your balance sheet updates automatically , no need to build spreadsheets or formulas. You’ll always know what you own, owe, and have left, all in one clean dashboard.

Income Statement vs Balance Sheet: The Real Difference

These two reports might sound similar, both talk about money, but they serve different purposes and answer different questions.

Here’s the easiest way to remember the balance sheet vs income statement difference:

- The income statement covers a time period — it shows how much money you earned and spent between two dates.

- The balance sheet covers a single date — it shows what your business owns and owes at that exact point in time.

One shows performance, the other shows position. One measures profitability, the other measures stability.

Both are connected , your profit (from the income statement) eventually becomes part of your retained earnings (on the balance sheet). That’s why accountants often say, “you can’t understand one without the other.”

If you’re running a small business, you need both. One helps you see if your operations are profitable. The other helps you know if your business can survive a rainy day.

With Adam by tyms, you also get to see your financial dashboard with insights.

Why Every Small Business Owner Needs Both Reports

Let’s say your income statement shows you’re making a $5,000 profit every month. That’s great!

But your balance sheet might show $25,000 in unpaid invoices and $15,000 in debt. Suddenly, that “profit” doesn’t look as comfortable, does it?

That’s why small business owners should use both together:

- The income statement tells you how well you’re doing.

- The balance sheet tells you how strong you are.

Together, they give you the full financial picture, performance and position, movement and moment.

And the good news? You no longer need to wait for an accountant or spend nights juggling spreadsheets. You can now generate both automatically from your bank statement using Adam by Tyms.

How to Generate an Income Statement and Balance Sheet from Your Bank Statement

Traditionally, building these reports took hours. You’d have to:

- Export transactions from your bank,

- Categorize every expense manually,

- Enter numbers into a spreadsheet,

- Calculate totals and balances,

- Double-check for errors.

Sounds exhausting, right? Now imagine doing all that in just a few clicks.

That’s exactly what Adam by Tyms does.

Here’s how:

- Connect your bank account or upload a statement, Adam securely pulls your transactions.

- Adam Auto-categorizes your transactions. It identifies what’s income, what’s expense, and what’s an asset or liability.

- Navigate to the report button by the side and generate your income statement with a click.

It’s accounting without the headache, fast, accurate, and built for business owners who’d rather focus on growth than spreadsheets.

Income Statement vs Balance Sheet: When to Use Each

So when should you use each report?

Use your income statement when you want to:

- Track business performance over time.

- Evaluate profitability month-to-month.

- Prepare for tax filing.

- Decide where to cut expenses or increase prices.

Use your balance sheet when you need to:

- Assess your company’s net worth.

- Apply for a loan or attract investors.

- Check how much debt your business carries.

- Ensure your assets cover your liabilities.

Together, they form the foundation of every good financial decision. That’s why even if you’re a freelancer or solo founder, understanding both is non-negotiable.

Common Mistakes When Reading Financial Statement

Many small business owners misunderstand these reports, and that’s okay. Here are a few pitfalls to avoid:

- Mixing personal and business expenses. This makes your income statement inaccurate and your balance sheet messy.

- Assuming profit equals cash flow. You might be profitable but still low on cash if customers haven’t paid yet.

- Forgetting to update loans or assets. Outdated data makes your reports misleading.

- Only checking reports once a year. Monthly reviews help you catch issues before they snowball.

With Adam by Tyms, these problems fade away , because your reports update in real time every time your bank does.

How Adam by Tyms Makes It Effortless

Adam was built for the modern entrepreneur, people who want clarity, not complexity.

Here’s what sets it apart:

- Bank-sync intelligence: Automatically connects to your accounts and updates reports.

- Smart categorization: Understands your income and expenses instantly.

- Real-time dashboards: Visualize your income statement and balance sheet difference at a glance.

- Tax readiness: Generate tax-friendly reports without hiring a bookkeeper.

- Simplicity: Designed for small business owners, freelancers, and consultants who don’t speak “accountant.”

So instead of spending weekends balancing numbers, you can spend that time planning growth, serving clients, or actually taking a break.

FAQs

1. What’s the main difference between an income statement and a balance sheet?

Income statement shows how much you earned and spent over time. The balance sheet shows what you own and owe at a specific moment.

2. Can I generate both from my bank statement?

Yes! Tools like Adam by Tyms let you upload your bank statement and instantly create both reports automatically.

3. Which one should I review more often?

Ideally, both — monthly. Your income statement tracks your performance; your balance sheet confirms your financial strength.

4. Do I need accounting skills to understand them?

Not at all. With tools like Adam, everything is visual, simple, and easy to grasp.

Conclusion

Understanding the difference between an income statement vs balance sheet isn’t just for accountants, it’s essential for every small business owner.

Your income statement tells you how much you made. Your balance sheet tells you what you’re worth.

And with Adam by Tyms, you can generate both from your bank statement in minutes, no formulas, no confusion, no stress.

You can also read:

Business Loan Financial Reports: What You Need & How to Create Them Automatically

Learn the exact financial reports lenders need for business loans , Income statement, balance sheet, cash flow, and how to create them instantly with Adam by Tyms.

Temitope Ayegbusi

Oct 10, 2025

The Fastest Way to Generate a Profit & Loss Statement

Are you looking for a quick and efficient way to create a simple profit and loss statement? Use our free income statement generator tool to get your report in minutes.

Temitope Ayegbusi

Sep 29, 2025