Catch-Up Bookkeeping Cost: What Small Businesses Really Pay (And How to Lower It)

So let’s touch on the question, How much does catch-up bookkeeping actually cost? and how to do it even cheaper.

Temitope Ayegbusi

Falling behind on bookkeeping is more common than most small business owners admit. A few missed months can turn into a year, and the cost to fix it also piles up alongside.

So let’s touch on the question, How much does catch-up bookkeeping actually cost?

The answer isn’t simple, because the cost depends on how you catch up. Some businesses pay thousands. Others fix their books for a fraction of that.

In this guide, we’ll break down:

- What catch-up bookkeeping really means

- How much it typically costs (with real ranges)

- Why prices vary so much

- The hidden costs most people don’t expect

- How small businesses lower catch-up bookkeeping costs using AI tools like Adam by Tyms

What is catch-up bookkeeping?

Catch-up bookkeeping is the process of bringing your financial records up to date after falling behind.

This usually includes:

- Reviewing months (or years) of bank transactions

- Categorizing income and expenses correctly

- Fixing duplicates and missing entries

- Reconciling bank and credit card statements

- Generating accurate financial reports

Catch-up bookkeeping is different from regular monthly bookkeeping because the data is usually messy, incomplete, or inconsistent. That mess is what drives the cost.

How much does catch-up bookkeeping cost?

Here’s what most small businesses in the U.S. actually pay. Average catch-up bookkeeping cost ranges

- For 1-3 months catch up, the cost can vary between $300-$1000

- For 6-12 months catch up, the cost can vary between $1200-$4000

- For 2+ years catch up, the cost can vary between $4000-$10000

These are one-time costs, not monthly fees. Some bookkeeping firms charge:

- Per month behind (e.g., $150–$300 per month)

- Per transaction

- Hourly rates ($50–$150/hour)

The more disorganized your books are, the more time it takes, and the higher the bill.

Why catch-up bookkeeping gets expensive fast

Many business owners assume the cost is based only on time. In reality, several factors push prices up.

1. Volume of transactions

A business with 50 transactions per month costs far less to clean up than one with 500.

2. Poor categorization

If expenses are randomly categorized or left uncategorized, the bookkeeper must review each one manually.

3. Missing records

Missing bank statements, receipts, or disconnected accounts increase time and cost.

4. Multiple accounts

More bank accounts, credit cards, or payment processors = more reconciliation work.

5. Urgency

If you need your books fixed fast (for taxes, loans, or investors), rush fees often apply.

The hidden cost most people don’t talk about

The biggest cost of catch-up bookkeeping is not the invoice.

It’s:

- Lost time explaining transactions

- Stress before tax deadlines

- Poor financial decisions due to unclear numbers

- Delayed funding or loan rejections

Many businesses delay catch-up work because of cost, only to pay more later.

Traditional catch-up bookkeeping vs DIY spreadsheets

Some business owners try to lower costs by doing catch-up bookkeeping themselves.

This usually means:

- Exporting bank statements

- Using spreadsheets

- Manually categorizing transactions

- Hoping it’s “good enough”

While this saves money upfront, it often creates:

- Inaccurate reports

- Missed deductions

- More cleanup later

This is where modern AI bookkeeping changes the equation.

How AI lowers catch-up bookkeeping costs

AI bookkeeping tools are designed for messy, real-world data.

Instead of starting from zero, they:

- Read transaction patterns

- Group similar expenses automatically

- Learn from corrections

- Generate reports without manual setup

This reduces the amount of human cleanup needed, which directly reduces cost.

Practical example: Lowering catch-up bookkeeping costs with Adam by Tyms

Let’s walk through how small businesses reduce catch-up costs using Adam by Tyms before paying for a service.

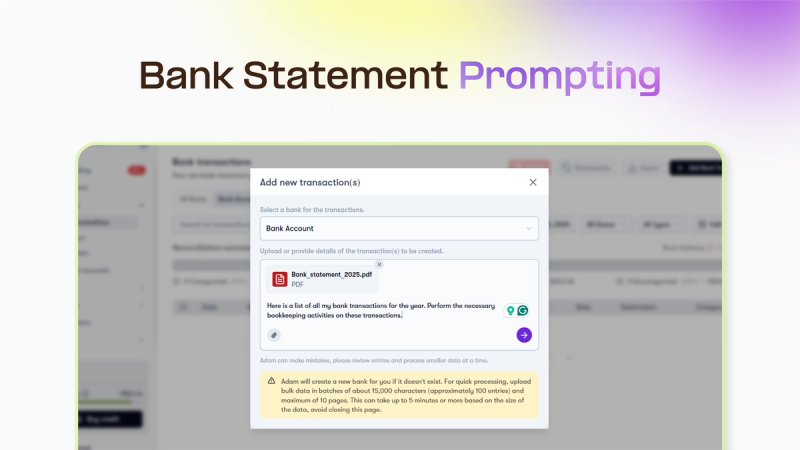

Step 1: Import historical bank data

Upload bank statements or connect accounts covering the period you’re behind on. Adam automatically reads and organizes transactions.

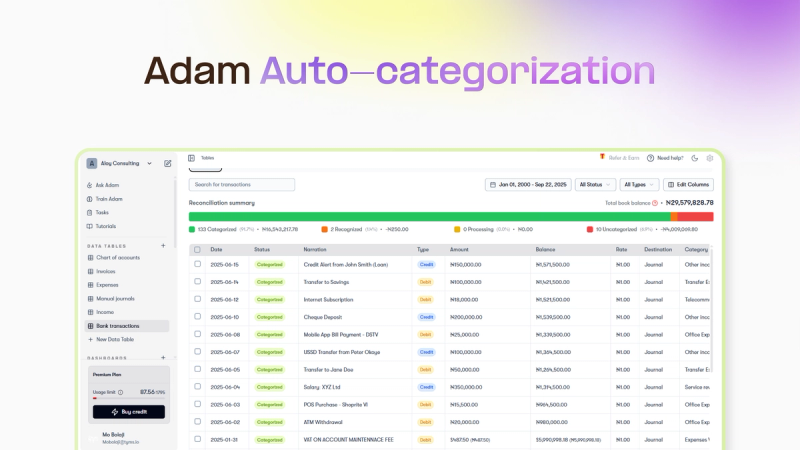

Step 2: AI-powered categorization

Transactions are categorized based on patterns:

- Income

- Marketing

- Software

- Operating expenses

This removes hours of manual sorting.

Step 3: Review and adjust

If a category is wrong, you correct it once. Adam learns and applies it across similar transactions.

Step 4: Generate clean reports

With transactions organized, Adam generates:

- Income statements

- Balance sheets

- Cash flow summaries

At this point, many businesses realize:

“Most of the catch-up work is already done.”

Step 5: Decide if professional help is still needed

If needed, a bookkeeper can now review clean, structured data, which significantly lowers their bill.

Catch-up bookkeeping cost comparison

Full-service catch-up bookkeeping - $1,200-$10,000

DIY Spreadsheets - Low upfront, high risk

AI-first approach (Adam by Tyms) - Significantly lower, flexible

This is why many businesses use AI before hiring a bookkeeper

How to avoid paying for catch-up bookkeeping again

Once your books are caught up, prevention matters.

To avoid repeat costs:

- Review transactions weekly (5–10 minutes)

- Keep accounts connected

- Use consistent categories

- Generate monthly reports

AI tools make this ongoing maintenance simple and affordable.

Want an AI-booking software to help you upload past bank statement and fix your books ? Try Adam by Tyms today

Frequently Asked Questions

How long does catch-up bookkeeping take?

Anywhere from a few days to several weeks, depending on how far behind you are.

Can I do catch-up bookkeeping myself?

Yes—but errors are common without the right tools.

Is AI bookkeeping accurate?

Accuracy improves as the system learns from your corrections.

Is catch-up bookkeeping tax-ready?

Yes, when done properly. Clean books make tax filing smoother and cheaper.

You can also read:

How to Catch Up on Bookkeeping (Without Hiring an Expensive Service)

Many small businesses search for catch up bookkeeping software when they want to fix overdue records without hiring a service.

Temitope Ayegbusi

Jan 14, 2026

How to Auto-Categorize Transactions from Your Bank Statement in Minutes

Learn how to auto-categorize bank transactions with Adam. Sync your U.S. bank, upload statements, or connect QuickBooks to get clean, accurate books for contractors, construction companies, and small businesses.

Temitope Ayegbusi

Sep 23, 2025