How to Auto-Categorize Transactions from Your Bank Statement in Minutes

Learn how to auto-categorize bank transactions with Adam. Sync your U.S. bank, upload statements, or connect QuickBooks to get clean, accurate books for contractors, construction companies, and small businesses.

Temitope Ayegbusi

Categorizing bank transactions manually is one of those accounting tasks that looks simple, until it isn’t. Once transactions start piling up across multiple bank accounts and credit cards, keeping everything accurate and up to date quickly becomes time-consuming and error-prone.

That’s why more businesses are looking for ways to categorize bank statements automatically. Not to replace accountants, but to reduce repetitive work, improve accuracy, and get financial reports ready faster.

In this guide, we’ll walk through how automatic transaction categorization works, what tools can help, and what to watch out for when setting it up.

Why manual transaction categorization slows teams down

Most accounting systems still rely on rules or manual categorization to classify transactions. This often means:

- Downloading bank statements

- Uploading CSV files

- Assigning categories line by line

- Fixing inconsistencies every month

As transaction volume grows, this process becomes difficult to scale. Even small errors, misclassified expenses, duplicates, or uncategorized entries can distort financial reports and delay decision-making.

If you’ve ever asked yourself how to categorize financial transactions faster without sacrificing accuracy, automation is the natural next step.

What automatic transaction categorization actually means

Automatic categorization doesn’t mean “set it and forget it.” At its core, it means using software to analyze transaction data and apply consistent accounting categories based on patterns such as:

- Merchant names

- Transaction descriptions

- Amount ranges

- Historical behavior

Modern tools can recognize repeat vendors, understand transaction context, and improve accuracy over time. This answers a common question many teams ask: can I categorize my transactions automatically? Yes, but the quality depends on the system you use.

How software categorizes bank and credit card data

When businesses look for auto-categorization tools for bank or credit card data, they’re usually trying to eliminate three steps: importing, sorting, and reviewing.

Here’s how the process typically works:

- Bank data is connected or uploaded

Transactions are pulled directly from bank feeds or uploaded as statements.

- Transactions are analyzed and classified

The system assigns categories based on learned patterns and accounting logic.

- Exceptions are flagged for review

Unusual or new transactions are surfaced instead of being blindly categorized.

- Reports update automatically

Financial statements reflect categorized data in near real time.

This workflow is what people are referring to when they search for expense auto categorization or spend auto categorization, they want less manual cleanup and more reliable outputs.

Tools that help classify financial transactions automatically

There are several tools on the market designed to reduce manual bookkeeping work. The key difference isn’t whether they automate categorization, but how well they do it.

Some tools rely heavily on static rules, which require ongoing maintenance. Others apply more adaptive logic that improves as more data flows through the system.

If you’re evaluating what tools help classify financial transactions automatically, look for platforms that:

- Handle bank and credit card transactions together

- Reduce manual rule creation

- Allow easy review and correction

- Produce clean reports without extra exports

This is where newer accounting platforms, like Adam by Tyms, focus on removing friction from categorization rather than adding another layer of setup.

A Practical Example: Automatically Categorizing Bank Transactions in Minutes

To make this more concrete, here’s what automatic transaction categorization looks like in practice using a modern accounting platform like Adam.

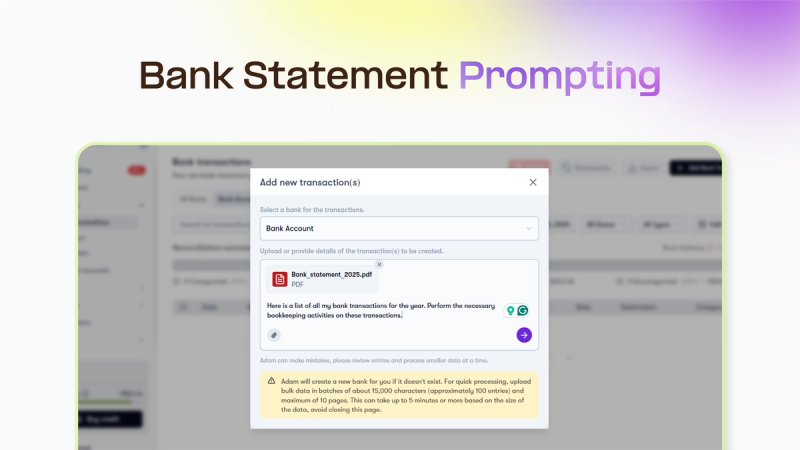

Step 1: Connect your bank or upload a statement

To begin, create an account with Adam by Tyms. Afterwards, you can link your US business bank account directly or upload a bank statement (PDF, CSV, or Excel). Transactions are imported securely and prepared for classification.

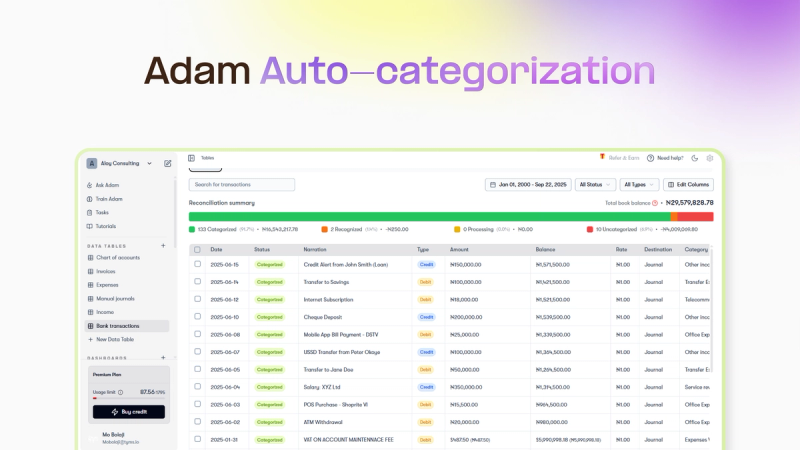

Step 2: Transactions are categorized automatically

Once the data is in, transactions are analyzed and grouped into the correct accounting categories, such as contractor payments, operating expenses, utilities, or professional fees, without manual sorting.

Step 3: Review and adjust when necessary

Any unusual or new transactions are flagged for review. You stay in control and can make quick adjustments, which helps improve accuracy over time.

Step 4: Financial reports update instantly

As soon as transactions are categorized, your profit & loss statement, balance sheet, and cash flow reports update automatically, no spreadsheets or manual recalculations required.

See how automatic transaction categorization works with real bank data using Adam

When automatic categorization works best (and when it doesn’t)

Automatic categorization performs best when:

- Vendors are consistent

- Transaction descriptions are clear

- Categories align with standard accounting practices

It may struggle when:

- Descriptions are vague

- One-off payments appear

- Data is incomplete

That’s why the best systems don’t just auto-assign—they surface edge cases. If you’ve wondered how to enable auto-categorizing of payments in my books without losing control, this balance is what to look for.

How this compares to traditional accounting software

Traditional accounting software often treats categorization as a manual or rule-heavy task. You define conditions, maintain exceptions, and periodically audit results.

Modern platforms shift the focus toward review instead of setup. That’s especially helpful for teams asking how to categorize banking transactions in accounting software automatically without spending hours configuring rules.

The result: faster month-end closes and cleaner financial data.

Is automatic categorization accurate enough for real accounting?

Used correctly, yes. Automatic categorization doesn’t replace accountants , it supports it. Most finance teams still review transactions, but they review far fewer of them.

That’s why many businesses moving away from spreadsheets and manual entry now rely on automation as a baseline, not an experiment.

FAQ:

1. Can I connect multiple bank accounts to Adam? Yes. Adam syncs transactions across multiple accounts and auto-categorizes them seamlessly.

2. Does Adam replace QuickBooks? Not if you don’t want it to. You can connect QuickBooks to Adam and let Adam handle categorization while keeping your QuickBooks setup.

3. How accurate is Adam compared to an accountant? Adam uses AI to learn your business. Over time, it categorizes with greater accuracy than manual rules, while saving you the cost of hiring a bookkeeper. It makes the accounting process easier and less expensive for you as a business owner.

4. Can I upload past statements? Yes. Adam can import past statements and auto-categorize years of data in minutes.

Final Thoughts

If transaction categorization is slowing down your books, automation isn’t a “nice to have”, it’s a practical upgrade. The goal isn’t perfection on day one, but consistency, speed, and visibility over time.

For businesses processing high volumes of bank and card transactions, automatic categorization helps keep financial data usable, current, and ready when decisions need to be made, sign up with Adam by Tyms today

You can also read:

Catch-Up Bookkeeping Cost: What Small Businesses Really Pay (And How to Lower It)

So let’s touch on the question, How much does catch-up bookkeeping actually cost? and how to do it even cheaper.

Temitope Ayegbusi

Jan 20, 2026

How to Catch Up on Bookkeeping (Without Hiring an Expensive Service)

Many small businesses search for catch up bookkeeping software when they want to fix overdue records without hiring a service.

Temitope Ayegbusi

Jan 14, 2026