How to Keep Digital Tax Records: A Guide for Small Businesses

A complete guide to digital record-keeping for small businesses, from expense tracking to tax-ready financial reports using AI accounting tools.

Temitope Ayegbusi

If you’re a small business owner, you’ve probably asked yourself: What records do I really need to keep? How should I keep them? And why does it even matter?

As tax agencies like the IRS in the U.S. push for digital-first compliance, now is the best time to move away from messy spreadsheets and piles of receipts.

Instead, small businesses are adopting AI accounting software and QuickBooks alternatives that simplify bookkeeping, and give owners real-time financial insights.

What Is Digital Record-Keeping?

Digital record-keeping means storing your financial information electronically instead of in physical form.

For small businesses, this can look like:

- Recording sales, expenses, and taxes in accounting software instead of notebooks.

- Storing invoices, bills, and receipts in the cloud instead of filing cabinets.

- Using an AI accounting software for small business (such as Adam by Tyms or QuickBooks alternatives like Xero or Wave) to manage small business expense tracking, bookkeeping, and tax submissions.

Many small businesses start with spreadsheets or a bookkeeping app . That works in the beginning, but as compliance rules tighten, AI tools provide the easy accounting software for small business that scales with growth.

Why Small Businesses Need Digital Tax Records

Government tax agencies expect businesses to keep accurate, organized records:

- In the U.K., Making Tax Digital (MTD) requires digital record-keeping with compliant software.

- In the U.S., while there’s no single “MTD” program, the IRS requires businesses to maintain records for audits, deductions, and loan applications.

Without proper record-keeping, small businesses risk penalties, missed deductions, and poor decision-making.

What Records Should Small Businesses Keep?

Every business, no matter how small, creates a financial trail. To stay compliant and truly understand your performance, you need to maintain accurate records across four major categories: assets, liabilities, income, and expenses.

Assets : represent what your business owns that carries value. This includes not only the obvious items like cash in the bank or equipment you’ve purchased, but also less visible items such as accounts receivable (money owed by customers).

For example, if you sell on credit and are waiting to be paid, that outstanding invoice is an asset, even though the cash hasn’t arrived yet. Keeping a digital record of assets ensures you can track your true worth and demonstrate financial health to investors or lenders.

Liabilities : Liabilities are the flip side: what your business owes. This could be a loan you took to start the business, an outstanding supplier invoice, or payroll you need to process.

Recording liabilities digitally helps you monitor obligations as they come due and prevents the all-too-common mistake of underestimating debt. When liabilities are clear and organized, you avoid late payment penalties and improve your chances of securing favorable credit.

Income (Revenue) : is the inflow of money from your products or services. But tracking income isn’t just about recording the amount that hits your bank account.

For proper reporting, you need to document when sales were made, which customers they came from, and what category they belong to.

For example, a café may want to separate dine-in sales from catering orders. Digital tools make this easy by tagging income streams automatically, so at year-end you can see which areas of the business are most profitable.

Expenses : are all the outflows—rent, utilities, software subscriptions, wages, travel, and even that quick business lunch with a client. Properly categorizing expenses is vital because it directly affects your taxable income.

A poorly categorized expense could be disallowed during an audit, costing you money. With digital record-keeping, expenses can be scanned, uploaded, and automatically matched to categories, ensuring every deduction is captured.

When these four categories are recorded accurately, they feed into the core financial reports—the Profit & Loss Statement, Balance Sheet, and Cash Flow Statement. These reports don’t just satisfy tax authorities; they give you a real-time picture of whether your business is thriving, struggling, or at risk.

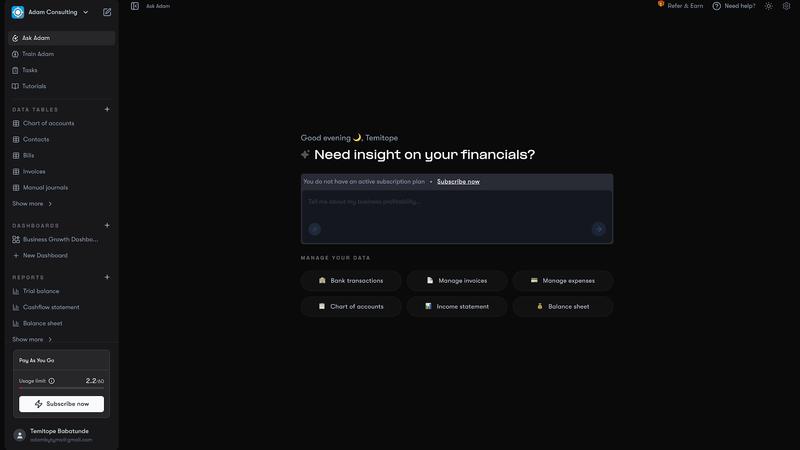

Instead of manually tracking these categories, Adam by Tyms automatically classifies transactions into assets, liabilities, income, and expenses. With one click, you can generate:

- Profit & Loss Statements

- Balance Sheets

- Cash Flow Reports

- Audit-Ready Tax Summaries

This eliminates guesswork and gives small businesses the same financial clarity that large companies enjoy.

Common Mistakes Businesses Make with Record-Keeping

Many small businesses fail at digital record-keeping not because they lack tools, but because of avoidable mistakes. Here are the most common:

- Mixing personal and business finances → creates confusion and errors during tax season.

- Relying on manual entry → typing data into spreadsheets leads to mistakes and isn’t tax-compliant.

- Poor categorization of expenses → misclassifying business meals as office supplies can cost you deductions.

- Losing or ignoring receipts → without proof, deductions may be rejected.

- Not backing up data → storing everything on one laptop without cloud backup is risky.

- Waiting until year-end → scrambling to fix books in April leads to errors and missed savings.

Avoiding these mistakes saves time, stress, and money.

Benefits of Digital Record-Keeping

Digital record-keeping transforms small business accounting:

- Easier expense tracking → every transaction auto-categorized.

- Tax-ready reporting → generate small business financial reports instantly.

- Time savings → automation replaces late-night spreadsheets.

- Smarter planning → compare revenue and costs by quarter.

- Lower costs → fewer penalties and less accountant cleanup.

How to Prepare and Organize Digital Tax Records with Adam

Switching to digital can feel overwhelming, but Adam makes it straightforward:

Step 1. Create your Adam account : Start with an AI-native accounting platform. Get started with Adam today

Step 2. Connect your bank : Adam imports past and ongoing transactions, instantly categorized.

Step 3. Upload or link existing data Already on QuickBooks or Excel? You can connect your Quickbooks account and continue seamlessly.

Step 4. Automate receipts Forward receipts from email or WhatsApp for instant recording. With Adam, you can sync your mail and whatsapp to capture receipts.

Step 5. Generate tax-ready reports From P&L statements to cash flow reports, Adam prepares everything you need for tax filing or accountant reviews.

How Accountants Fit In

Even with AI accounting software, accountants still play a vital role:

- Managing complex revenue models or payroll

- Providing strategic tax planning

- Representing you during audits

With Adam or other QuickBooks alternatives for small business handling the daily bookkeeping, accountants focus on strategy rather than cleanup, saving you money and adding long-term value.

Digital Record-Keeping FAQs

1. How long should I keep digital tax records?

At least 6 years, depending on jurisdiction.

2. Can I still keep paper copies?

Yes, but digital records are mandatory under MTD (U.K.) and strongly advised for IRS compliance in the U.S.

3. What is the best AI accounting software for taxes?

Adam by Tyms is one of the best QuickBooks alternatives for small business. it automates expense tracking, generates reports, and simplifies compliance.

4. Can I still use spreadsheets for small business expense tracking?

Yes, but only if linked digitally to compliant software. Manual copy-paste isn’t accepted.

5. Which financial statements do I need for taxes?

At minimum: Profit & Loss Statement, Balance Sheet, and Cash Flow Report.

6. What if I already use QuickBooks?

You can integrate it with Adam to continue where you left off while gaining AI-powered automation.

7. Do landlords and self-employed businesses need digital records? Yes—especially under Making Tax Digital in the U.K. or IRS audits in the U.S

By organizing assets, liabilities, income, and expenses digitally, you’ll always know your true financial position. Ready to simplify tax compliance and reporting? Get started with Adam today and keep your digital tax records accurate, automated, and stress-free.

You can also read:

Master your finance with a free Excel Income Statement Template

Using an Excel income statement template isn't just about filling in numbers; it's about getting a clearer picture of how your business is actually doing.

Temitope Ayegbusi

Jan 30, 2026

Accounting Automation Software Features That Actually Matter (For Small Businesses)

This guide breaks down accounting automation software features that truly matter, explains how popular tools approach automation, and helps small business owners understand what to look for before choosing the wrong solution.

Temitope Ayegbusi

Jan 22, 2026