The Difference Between Assets and Liabilities (and Why It Matters for Your Business)

Learn the difference between assets and liabilities in simple terms. See real examples, key ratios, and how AI accounting software like Adam by Tyms automates your balance sheet.

Temitope Ayegbusi

You’ve poured time, money, and energy into your business. Some days, cash flow feels strong, you clear out pending invoices, orders come in. Other days, bills stack up, and you wonder if the numbers will balance. That constant pull between what you own and what you owe is at the heart of every business’s financial story.

This guide breaks down the difference between assets and liabilities in plain English so you can read your balance sheet with confidence. You’ll learn where items belong, how they affect equity, and which key ratios reveal your company’s financial strength or early warning signs.

Along the way, you’ll see real-world examples from service firms, product companies, and trade businesses, plus how Adam by Tyms, an AI-powered accounting software, automatically maps assets, liabilities, and transactions in real time. That means fewer errors, faster reports, and more time to focus on growth.

Key Takeaways

- Understand what your business owns vs what it owes, the foundation of financial health.

- Learn where assets and liabilities appear on the balance sheet and how they affect equity.

- Use simple ratios to track cash flow, coverage, and debt levels.

- Apply examples from real businesses to your own chart of accounts.

- Automate categorization with Adam by Tyms for faster, cleaner financial reporting.

Understanding the Basics: Assets, Liabilities, and Equity

Running a small business means constantly balancing short-term cash flow and long-term value. To make smart decisions, you need a clear picture of three core elements: assets, liabilities, and equity.

What Are Assets?

Assets are everything your business owns that provides future benefit, to mention a few, we have, cash in the bank, receivables you’ll collect, inventory ready to sell, or equipment used to deliver services. Assets represent resources that drive future revenue.

What Are Liabilities?

Liabilities are what your business owes, credit cards, unpaid bills, loans, or payroll taxes. They’re obligations that limit flexibility and need repayment over time.

How Equity Fits In

The accounting equation ties it all together: Assets − Liabilities = Equity. Equity shows what’s left for you (the owner) after paying all obligations. It’s your company’s net worth.

Reading Your Balance Sheet: Assets vs Liabilities in Action

A clean balance sheet helps you spot cash pressures early and plan your next move confidently.

How It’s Structured

In the U.S., a balance sheet lists assets first, followed by liabilities, then equity, mirroring the accounting equation.

- Current assets like cash, receivables, and inventory appear first.

- Current liabilities such as payables, credit cards, and accrued wages are grouped together.

- Long-term assets and debts follow.

This structure shows whether your near-term resources can cover short-term debts, a key measure of liquidity.

Real-World Examples You Can Map to Your Accounts

Service Firms

- Assets: Cash, laptops, accounts receivable

- Liabilities: Credit cards, unpaid vendor bills, sales tax payable

Product Businesses

- Assets: Inventory, equipment, property

- Liabilities: Lines of credit, payroll taxes, mortgages

Project-Based Trades

- Assets: Vans, tools, customer deposits

- Liabilities: Bank loans, accrued wages, taxes payable

Both tangible (equipment, real estate) and intangible (patents, customer lists) assets carry value, but they require different tracking methods.

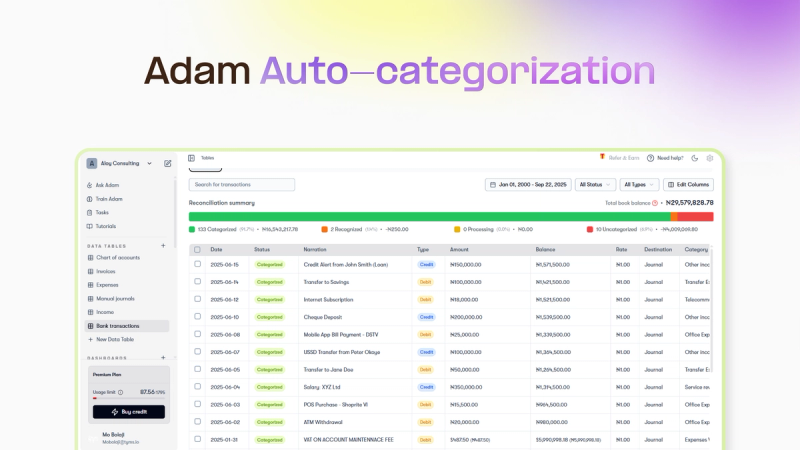

Why Auto Categorization Improves your Financial Reporting

Manual bookkeeping introduces errors that distort your reports. Automated categorization fixes that by mapping each transaction to the correct account instantly , cutting time spent on reconciliation and tax prep.

You can easily know which is asset, liability, you can as well see financial statements to help understand your business financial strength at a go.

When your entries are clean:

- Reports are accurate and audit-ready.

- Tax deductions are easier to claim.

- You gain real visibility into cash flow and debt coverage.

Adam by Tyms allows you to categorize your transactions without having to do any manual entries.

How to Apply This Today

- List and tag all current assets, current liabilities, and long-term items.

- Set rules for AR, AP, inventory, and loans to ensure proper mapping.

- Use Adam by Tyms to autocategorize your transactions.

- Review monthly: reconcile accounts, check ratios, and lock the period for accuracy.

- Audit quarterly: after any new vendors, loans, or equipment purchases.

How to categorize your transaction using Adam by tyms

Step 1: Create an Account with Adam

Sign up in seconds. No complex setup. Just your email and password, and you’re in. Create your Adam account here

Step 2: Direct Bank Sync (The Easiest Way)

The fastest way to auto-categorize transactions is through Adam’s direct bank sync feature. Instead of downloading and uploading statements every month, you simply connect your U.S. bank account to Adam.

- Adam imports both past and current transactions instantly.

- Every payment, deposit, and expense is automatically categorized by AI.

- Duplicates or missing entries are flagged for review.

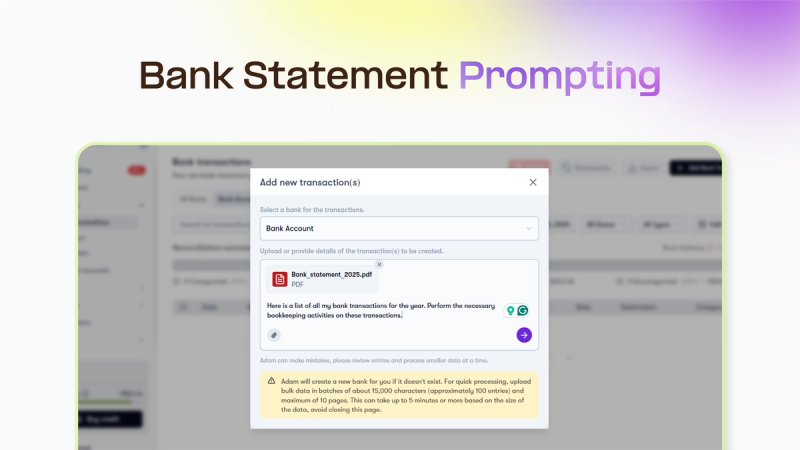

Step 3: Upload Bank Statements (When You Need To)

If you prefer working with statements, Adam also lets you upload PDFs , Excel, or CSVs .

Unlike QuickBooks, which imports everything as raw data, Adam uses AI to categorize each line item automatically.

- That $600 payment to “Lowe’s”? Tagged as materials.

- That $1,200 Stripe deposit? Categorized as client income.

- That monthly SaaS charge? Labeled recurring expense.

The difference between assets and liabilities defines your company’s financial stability. When those categories are clean, your reports reflect reality, helping you plan growth, manage debt, and build equity.

Let automation handle the complexity. Adam by Tyms auto-categorizes transactions, updates balance sheets in real time, and helps small businesses stay accurate, compliant, and ready for any financial decision.

You can also read:

Master your finance with a free Excel Income Statement Template

Using an Excel income statement template isn't just about filling in numbers; it's about getting a clearer picture of how your business is actually doing.

Temitope Ayegbusi

Jan 30, 2026

Accounting Automation Software Features That Actually Matter (For Small Businesses)

This guide breaks down accounting automation software features that truly matter, explains how popular tools approach automation, and helps small business owners understand what to look for before choosing the wrong solution.

Temitope Ayegbusi

Jan 22, 2026