Why Manual Bookkeeping Causes Tax Errors — And How AI Accounting Software Can Help

Manual bookkeeping leads to costly tax mistakes and missed deductions. Learn how AI accounting software like Adam by Tyms automates bookkeeping, reduces errors, and keeps your small business tax-ready all year.

Temitope Ayegbusi

Manual bookkeeping causes tax errors because it relies heavily on human input. Every misclassified expense, forgotten receipt, or duplicate entry affects your tax calculation. When financial records are handled through spreadsheets, paper receipts, or traditional bookkeeping apps that require manual work, errors become inevitable and costly.

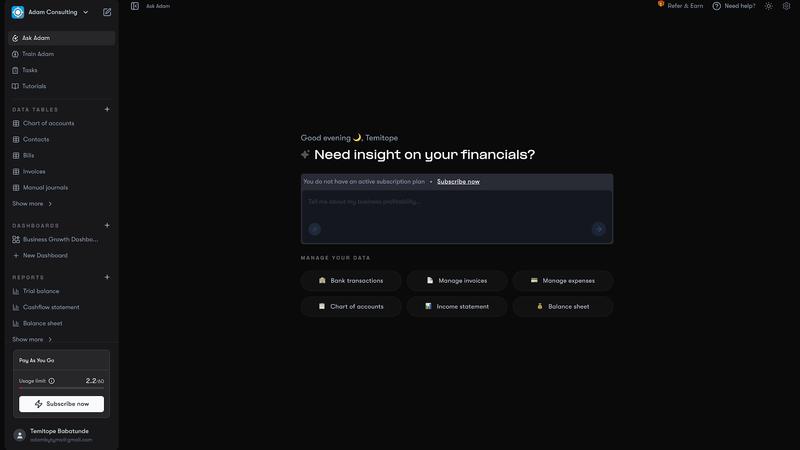

AI accounting software like Adam by Tyms removes the manual bottlenecks that cause those errors. Adam automatically imports your transactions, categorizes expenses, detects duplicates, and generates tax-ready financial reports instantly.

Instead of cleaning up messy books every tax season, you get clean and accurate financial records all year, making taxes, audits, and business decisions much easier..

What tax errors are common with manual bookkeeping?

Manual bookkeeping commonly leads to mistakes such as:

- Misclassified expenses

- Duplicate entries from copy-paste errors

- Missing transactions

- Inaccurate financial statements

- Inflated or understated revenue

- Disorganized receipts

These errors accumulate over months and become major issues during tax season.

Why does manual bookkeeping lead to missed deductions?

Missed deductions happen when expenses are:

- Categorized incorrectly

- Recorded late

- Not tracked at all

- Lost in paper or WhatsApp receipts

- Entered inconsistently

AI eliminates these issues by automatically categorizing every transaction and keeping your financial data up to date.

How Adam by Tyms AI Accounting Software Helps your business accounting processes.

Today's best AI accounting software for small business doesn’t just replace spreadsheets or tools like Quickbooks, Zoho,etc, it upgrades your entire financial workflow.

Here’s what it can do for you:

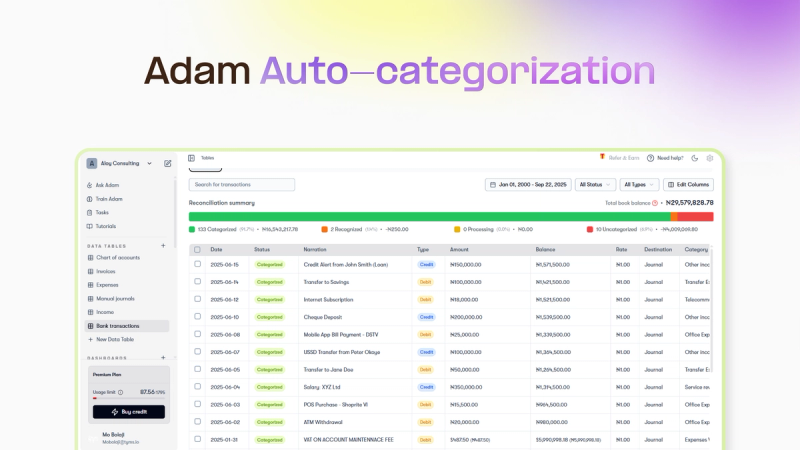

1. Automated Expense Tracking and Categorization

The moment you connect your bank or upload your bank statement on Adam by Tyms, every transaction is:

- Auto-imported

- Intelligently categorized (e.g., rent, subscriptions, client payments)

- Flagged if it's a duplicate or unusual

You don’t have to worry about a chart of accounts or accounting rules, the AI handles it behind the scenes.

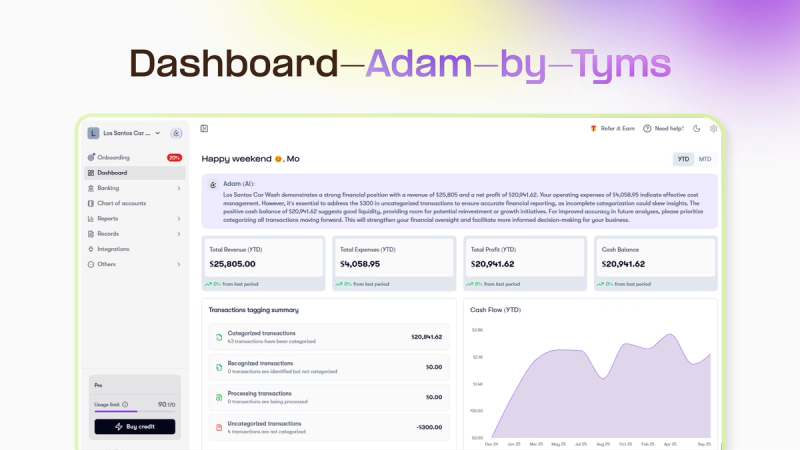

2. One-Click Financial Statements

Need an income statement for a loan application? Or a cash flow report for your tax advisor?

Just click Reports on the Adams by Tyms software, and your:

- Profit & Loss Statement

- Balance Sheet

- Cash Flow Statement

- Trial Balance

are ready to download, export, or email, no formulas or templates required.

If you've ever Googled If you’ve ever searched for:

- best QuickBooks alternatives

- AI accounting software for small business

- how to create income statement

- bookkeeping app for small business

…then Adam by Tyms is your answer.

3. Built-In Accuracy and Tax Compliance

AI doesn’t get tired, distracted, or confused by receipts.

- It can detect duplicate or missing entries

- Keep consistent records month after month

- Create audit-ready reports for peace of mind

Can Adam help detect duplicate or missing transactions?

Yes. Adam automatically:

- Flags duplicate entries

- Prevents duplicate imports

- Identifies potential missing transactions

- Ensures income and expenses are fully captured

This ensures your financial records remain accurate and audit-ready.

How does AI bookkeeping save money on accountant fees?

Manual bookkeeping errors usually force business owners to hire accountants to fix messy books which is an expensive process.

Adam reduces the need for cleanup by preventing errors early. For many small businesses, this cuts annual bookkeeping and tax-prep costs by up to 70%.

Is Adam by Tyms good for small businesses, freelancers, and startups?

Yes. Adam is designed specifically for:

- Small business owners

- Freelancers

- Side hustlers

- Agencies

- Retail shops

- Online businesses

- Startups

Anyone who wants automated, stress-free bookkeeping will find Adam easy, fast, and reliable.

Manual bookkeeping doesn’t just waste time, it creates tax errors, missed deductions, and messy financial records.

By switching to AI accounting software like Adam by Tyms, you automate the entire bookkeeping process, reduce human error, and stay tax-ready all year.

If you're tired of fixing spreadsheets or paying extra for last-minute accounting help, it's time to let AI handle your books.

Get started with Adam by Tyms today and keep your business financially organized with zero stress.

You can also read:

How to Catch Up on Bookkeeping (Without Hiring an Expensive Service)

Many small businesses search for catch up bookkeeping software when they want to fix overdue records without hiring a service.

Temitope Ayegbusi

Jan 14, 2026

QuickBooks Pricing 2025: Full Breakdown and a Better Alternative That Saves You Hours

If you’re still comparing options or want to understand QuickBooks pricing in 2025, see our full breakdown of QuickBooks pricing and alternatives

Temitope Ayegbusi

Dec 15, 2025