Features to Look for in Salon Accounting Software

Managing a salon is tough without the right tools. See the top features every accounting software for salon should have in 2025 — from commission tracking to AI-powered reporting.

Temitope Ayegbusi

If you’re running a salon (or plan to), you need more than just an invoice app. This guide walks you through real workflows, pricing, comparisons and checklists to pick the right tool (and yes, we include one called Adam by Tyms).

Here is a quick summary based on use case in 2025

- If you hate bookkeeping and manual categorization of your expenses, and income, and you desire AI-native, sync with banks/email/whatsapp, and full automation of your accounting or bookkeeping processes. Choose Adam by Tyms, try it out for $1 today.

- If you have multiple locations and want to track inventory, multibranch payroll. Try tyms.

If you want a specialized manual tool you can use with your dedicated accountant, try Bouleverd.

For many owners, managing these numbers manually becomes overwhelming and costly. That’s why choosing the right accounting software for salon businesses in 2025 is crucial.

In this guide, we’ll break down:

- Why salons need specialized bookkeeping

- The hidden costs of manual accounting

- The best salon bookkeeping app options

- Key features to look for in modern solutions

Why Salons Need Specialized Accounting Software

Managing a salon isn’t the same as managing a coffee shop or a standard small business. Behind every chair and every retail product lie unique financial movements: stylist commissions, tip piles, product inventory, rental revenue, etc.

A generic bookkeeping tool might cover basic expenses and invoices, but it often falls short when you start mixing service revenue, retail sales, contractor payments and tax-specific issues.

For example:

- Stylists working on commission make payroll tricky.

- Retail inventory and services side by side complicate margins.

- Booth rentals or mobile stylists mean revenue streams that aren’t just “client pays service”.

If you don’t use software that knows what “tip pooling”, “chair rent” or “gift-card breakage” mean, you’ll end up with spreadsheets and headaches.

Without the right salon accounting software, these moving parts often create errors that snowball into bigger financial problems.

The Hidden Costs of Manual Salon Bookkeeping

It may feel cost-effective to manage finances using spreadsheets, but here’s the real cost:

- Misclassified expenses = missed deductions

- Duplicate entries = false profit numbers

- Lost receipts = incomplete records

- Late reports = missed deadlines with landlords, lenders, or the IRS

To add to the list, fixing these errors later, means hiring an accountant, which can cost thousands a year.

Money that could be used for staff training, marketing, or new equipment instead. That’s why smart owners are turning to easy accounting software for small business, to save time and protect profits.

Top Bookkeeping Challenges Every Salon Owner Faces (and How to Avoid Them)

Here are some of the most common salon-specific accounting problems you should watch out for, and what to do about them.

- Tips and Commissions: Keeping track of who earned what can get messy fast. Cash tips, card tips, service commissions, retail commissions, each needs to be recorded and split accurately among stylists.

- Booth Rentals and Contractors: If your salon rents out chairs or works with independent stylists, managing payments, invoices, and end-of-year 1099s can turn into a full-time job.

- Gift Cards, Deposits, and Taxes: Selling gift cards or taking deposits is great for cash flow, but they come with accounting headaches. Add in the confusion around which services or products are taxable (depending on your state), and things can get tricky.

- Inventory and Product Costs: From shampoos to styling products, keeping tabs on what’s used, what’s sold, and what’s missing (shrinkage) is key to knowing your true costs and profits.

Features to Look for in Salon Accounting Software

When choosing the right tool, prioritize features that address salon-specific needs:

1. Commission & Payroll Tracking

Ability to see and understand stylist commissions automatically without messy spreadsheets.

2. Contractor Expense Tracking

Ability to easily record payments for part-time stylists, nail technicians, or freelance specialists.

3. Automated Expense Categorization

Ability to AI categorize rent, utilities, product purchases, and subscriptions without manual effort.

4. Inventory-Linked Accounting

Ability to track product usage and retail sales directly in your books for clearer margins.

5. Simple Financial Reporting

Ability to generate profit & loss statements for small business owners in one click, no accountant required.

6. Tax-Ready Reports

Ability to export IRS-compliant records and avoid costly mistakes at filing time.

7. Mobile-Friendly Salon Bookkeeping App

Ability to manage finances between appointments with a tool designed for busy salon owners.

8. AI-Powered Accuracy

Ability to flag duplicates, detect missing entries, and generate reliable small business financial reports.

The Best Accounting Software for Salons in 2025

Here are the top tools making a difference for salon owners this year:

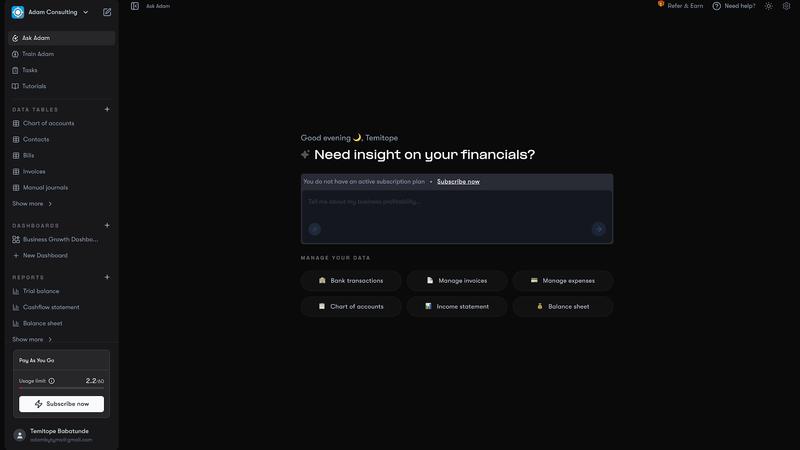

1. Adam by Tyms (AI-Powered Salon Accounting)

Adam by Tyms is an AI-native tool designed for service businesses like salons. It eliminates manual bookkeeping by automatically syncing with banks, WhatsApp, and email receipts.

Key Features:

- Automated expense tracking & categorization

- One-click profit & loss statements for small business

- Duplicate detection & error-free reporting

- Mobile-friendly salon bookkeeping app

- Real-time dashboards customized to your needs

Perfect for salon owners seeking easy accounting software for small business without accounting experience. Salon owners with a QuickBooks account, also have the ability to connect their QuickBooks account to Adam by tyms, and the rest they say is done for you by the Adam software, with minimal involvement. Get Started with Adam by Tyms

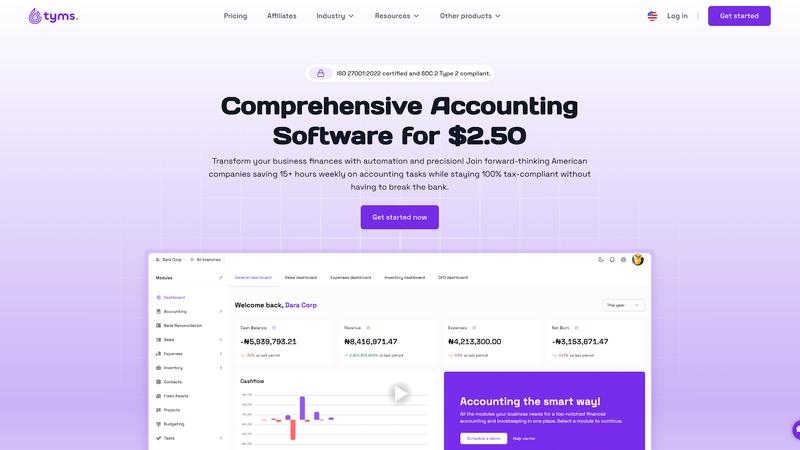

2. Tyms (All-in-One Accounting for Growing Salons)

Best for salons expanding across multiple locations.

- Payroll & commission management

- Inventory integration

- Consolidated branch reporting

- Contractor and freelancer expense tracking

3. QuickBooks (Popular but Complex)

Widely used in the U.S., QuickBooks offers strong payroll and tax features. However, it requires manual categorization and CSV uploads, which slows down salon owners. Best for those with bookkeeping experience or working alongside an accountant.

Real Costs & Pricing: What You’ll Pay for accounting software in 2025

Let’s get transparent: pricing ranges vary a lot. Based on recent market sources:

- Many salon and inventory software products start at $0-$25/month for basic tiers. You can have access to Adam by tyms for as low as $1 trial and $18 starter plan.

- More feature-rich tools (inventory + payroll + POS + multi-location) range $100-$150/month (sometimes more) for small chains.

- Enterprise / multi-location solutions can be $400+/month per location.

Additional cost factors to watch:

- Setup or onboarding fees

- Add-ons (POS, payroll, advanced reporting)

- Payment processing or built-in POS fees

- Employee vs contractor seats

- Locations count or chair count

Why AI Accounting is the Future for Salons

Unlike traditional systems, AI-powered accounting software for salon businesses learns from your transactions and improves accuracy over time.

With automation, salon owners benefit from:

- No wasted hours on spreadsheets

- No missed tax deductions

- No stress applying for loans or expanding locations

Instead, you gain peace of mind knowing your numbers are accurate, reports are IRS-ready, and growth decisions are backed by clean data.

FAQs On Salon Accounting Software

1. What is the best accounting software for salons? The best option depends on your needs. For AI-powered accuracy, Adam by Tyms is ideal. For multi-location growth, Tyms works well. QuickBooks suits accountants, while FreshBooks and Zoho are better for freelancers.

2. Do salons need special bookkeeping software? Yes. Generic tools don’t handle commission tracking, contractor payments, or cash-heavy transactions effectively. Specialized salon accounting software save time and reduce costly mistakes.

3. Can salon software track commissions and tips? Yes. The best salon accounting software includes commission tracking and allows you to record cash tips alongside card payments.

4. What financial reports do salons need for taxes? At a minimum, salons need a profit & loss statement for small business, balance sheet, and cash flow statement. Automated tools generate these instantly.

Running a salon is already demanding. Manual bookkeeping or generic tools only add stress, errors, and unnecessary costs. In 2025, the smartest salon owners are turning to AI-driven accounting software for salon businesses , tools that simplify payroll, automate expense tracking, and deliver tax-ready reports in seconds.

If you want to spend less time on spreadsheets or complex accounting tools and more time delighting clients, investing in the right salon bookkeeping app may be the best decision you make this year. Sign up on Adam by Tyms

You can also read:

Master your finance with a free Excel Income Statement Template

Using an Excel income statement template isn't just about filling in numbers; it's about getting a clearer picture of how your business is actually doing.

Temitope Ayegbusi

Jan 30, 2026

Accounting Automation Software Features That Actually Matter (For Small Businesses)

This guide breaks down accounting automation software features that truly matter, explains how popular tools approach automation, and helps small business owners understand what to look for before choosing the wrong solution.

Temitope Ayegbusi

Jan 22, 2026